Mortgage Rates Today: The Unvarnished Truth

Mortgage Rates Hit 2025 Low: Don't Pop the Champagne Yet

The "Lowest Rate of the Year" Mirage

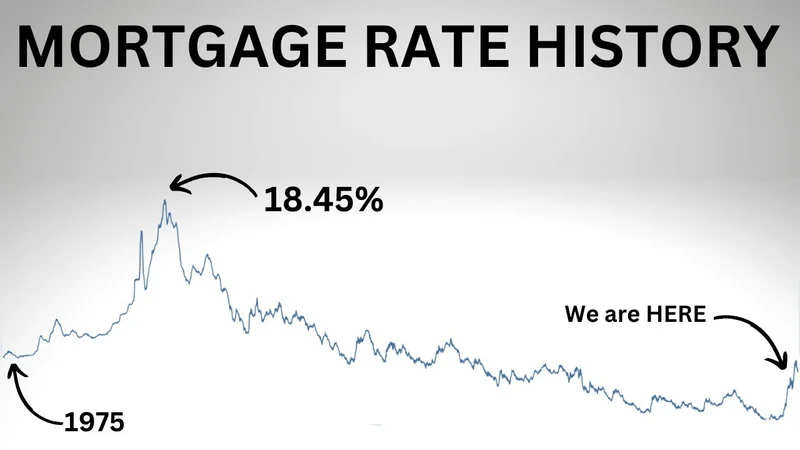

So, mortgage rates are supposedly at their lowest point in 2025, hovering around 6.06% for a 30-year fixed. That’s what Zillow data is telling us, anyway. Everyone gets excited about "lows," but let's inject a dose of reality. We’re still talking about rates that are significantly higher than what anyone saw pre-2023. Remember the 3% rates? Seems like a lifetime ago.

This "lowest rate" claim needs context. It's the lowest this year. The financial media loves to grab onto these little victories, but it's like celebrating a slightly less painful root canal. It's still a root canal. And a 6.06% rate on a $400,000 mortgage means you're still forking over close to $2,400 every month just for principal and interest. That doesn't include taxes, insurance, or the inevitable leaky faucet repair.

The real question is: why are we still stuck above 6%? The Fed supposedly cut rates twice this year, including at its late October meeting. Usually, those cuts translate to lower mortgage rates. But it seems like the market's absorbing those cuts, or maybe the lenders are just padding their margins. What I find genuinely puzzling is that the 30-year rate was also 6.06% in late October. So, we are basically at the same point we were a month ago. Are we sure there is a real trend downward?

The Affordability Crisis Deepens

Here's the cold, hard truth: even with this "low," home affordability is still a major problem. As one of the source articles points out, property pricing is primarily supported by the amount a buyer can borrow. High mortgage rates translate directly into reduced buying power.

Consider this: a buyer who could comfortably afford a $400,000 home at a 3% interest rate is now looking at something closer to $300,000, maybe even less. That's a massive drop in what people can afford, and it's forcing many potential buyers to the sidelines. The article says buyers are "increasingly heading for the sidelines—ready and able, but more often less willing to borrow and buy." That's a nice way of saying people are priced out.

And let's not forget adjustable-rate mortgages (ARMs). They're always lurking, tempting buyers with slightly lower initial rates. But as the article notes, the "downside is the significant forward risks of loss-by-foreclosure inherent in ARMs when rates trend higher." It's a gamble, and right now, it feels like a sucker's bet. Is a slightly lower rate worth the risk of your payment potentially skyrocketing in a few years? My analysis suggests that, for most people, the answer is a firm no.

The other factor to consider is government interference. As one of the sources points out, "current government interference with the economy is spilling over into real estate by adversely affecting homebuyer willingness, user turnover rate, and costs of construction." You can't just wave a magic wand and fix the housing market. There are too many moving parts, too many external factors at play.

A Glimmer of Hope, or Just Wishful Thinking?

So, what's the takeaway? Are we doomed to high mortgage rates forever? Probably not. The Fed is considering another rate cut in December, and that could provide some relief. But I wouldn't hold my breath. Even if rates do drop slightly, we're still a long way from the affordability levels we saw just a few years ago.

Plus, there's the whole issue of economic volatility. As Lisa Sturtevant, Bright MLS's chief economist, points out, it will take some time for economic reports to provide up-to-date information, which could lead to increased volatility throughout the rest of the year. That means rates could swing wildly in either direction, making it even harder to predict where things are headed.

Reality Check: Still Too Expensive

The truth is, a "low" in 2025 is still painfully high compared to historical norms. Don't expect a housing market resurgence until rates come down significantly and stay there. Until then, it's a buyer's market... if you can afford it.

Tags: mortgage rates today

Economic Calendar: The Dates They Want You To See vs. The Reality

Next PostIrys: What It Is, and What You Need to Know

Related Articles